The Best Guide To Amur Capital Management Corporation

The Best Guide To Amur Capital Management Corporation

Blog Article

Get This Report on Amur Capital Management Corporation

Table of ContentsThe Main Principles Of Amur Capital Management Corporation Amur Capital Management Corporation Fundamentals ExplainedAmur Capital Management Corporation Things To Know Before You BuyAmur Capital Management Corporation Can Be Fun For EveryoneIndicators on Amur Capital Management Corporation You Should KnowAbout Amur Capital Management Corporation6 Simple Techniques For Amur Capital Management Corporation

A low P/E proportion may suggest that a business is underestimated, or that financiers expect the company to encounter much more hard times ahead. Capitalists can utilize the ordinary P/E proportion of various other firms in the same industry to develop a baseline.

9 Simple Techniques For Amur Capital Management Corporation

A stock's P/E proportion is very easy to find on many financial reporting web sites. This number indicates the volatility of a supply in comparison to the market as a whole.

A supply with a beta of over 1 is theoretically extra volatile than the marketplace. As an example, a safety and security with a beta of 1.3 is 30% even more volatile than the marketplace. If the S&P 500 increases 5%, a supply with a beta of 1. https://www.bitchute.com/channel/wfTS3rtGiDAM/.3 can be expected to rise by 8%

All about Amur Capital Management Corporation

EPS is a buck number representing the portion of a business's revenues, after taxes and preferred stock dividends, that is designated to every share of common stock. Financiers can utilize this number to determine exactly how well a firm can deliver worth to investors. A greater EPS begets higher share prices.

If a company on a regular basis falls short to supply on revenues projections, a capitalist might wish to reevaluate buying the supply - passive income. The computation is straightforward. If a business has an earnings of $40 million and pays $4 million in returns, after that the remaining sum of $36 million is split by the number of shares impressive

Facts About Amur Capital Management Corporation Uncovered

Capitalists frequently get curious about a supply after reading headlines concerning its phenomenal performance. Simply keep in mind, that's yesterday's information. Or, as the investing sales brochures always phrase it, "Previous performance is not a predictor of future returns." Audio investing decisions must take into consideration context. A consider the trend in rates over the previous 52 weeks at the least is necessary to obtain a sense of where a supply's cost might go following.

Allow's check out what these terms imply, exactly their website how they vary and which one is finest for the typical investor. Technical analysts brush via massive quantities of data in an effort to forecast the direction of stock costs. The data consists mainly of previous rates info and trading volume. Essential analysis fits the requirements of the majority of investors and has the advantage of making good feeling in the real life.

They believe rates adhere to a pattern, and if they can figure out the pattern they can maximize it with well-timed trades. In current decades, innovation has actually allowed more financiers to exercise this design of investing because the tools and the data are much more available than ever before. Fundamental experts consider the intrinsic worth of a stock.

Not known Details About Amur Capital Management Corporation

Most of the principles went over throughout this piece are typical in the fundamental expert's world. Technical analysis is best suited to someone that has the time and comfort degree with information to place endless numbers to make use of. Or else, basic analysis will fit the needs of the majority of investors, and it has the advantage of making good sense in the real life.

Brokerage firm charges and shared fund cost proportions pull money from your profile. Those expenses cost you today and in the future. For example, over a duration of twenty years, yearly costs of 0.50% on a $100,000 financial investment will lower the portfolio's worth by $10,000. Over the same period, a 1% fee will certainly lower the very same profile by $30,000.

The trend is with you (https://dzone.com/users/5144927/amurcapitalmc.html). Take advantage of the trend and shop around for the least expensive expense.

Little Known Questions About Amur Capital Management Corporation.

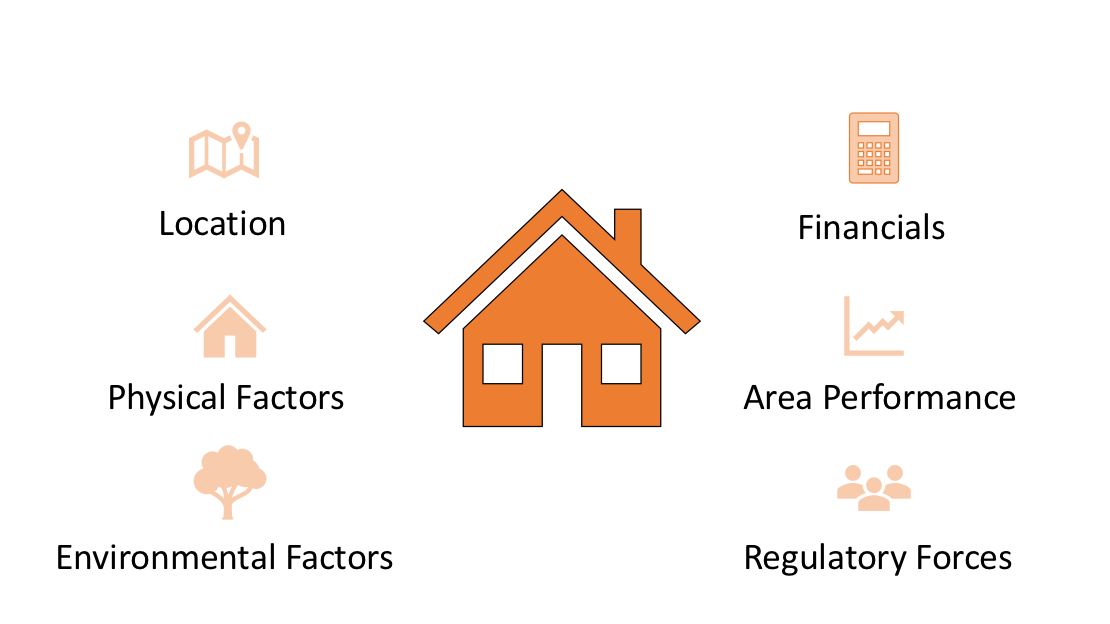

, environment-friendly area, beautiful views, and the community's standing variable prominently into domestic building valuations. A vital when considering residential or commercial property area is the mid-to-long-term sight pertaining to just how the area is anticipated to evolve over the financial investment period.

The Main Principles Of Amur Capital Management Corporation

Extensively evaluate the possession and designated usage of the instant locations where you plan to spend. One method to accumulate info about the prospects of the location of the home you are taking into consideration is to call the community hall or other public companies in fee of zoning and urban preparation.

Building evaluation is crucial for funding throughout the acquisition, sale price, financial investment evaluation, insurance policy, and taxationthey all depend upon genuine estate evaluation. Commonly utilized property appraisal methods include: Sales comparison technique: current equivalent sales of buildings with comparable characteristicsmost typical and appropriate for both new and old homes Expense method: the price of the land and construction, minus devaluation ideal for new building Income strategy: based upon predicted money inflowssuitable for leasings Offered the low liquidity and high-value investment in realty, a lack of quality purposefully may lead to unanticipated outcomes, consisting of economic distressspecifically if the financial investment is mortgaged. This provides regular income and long-term worth admiration. However, the temperament to be a landlord is required to manage possible disputes and lawful problems, handle occupants, repair, etc. This is usually for quick, little to tool profitthe normal property is under building and construction and cost a profit on conclusion.

Report this page